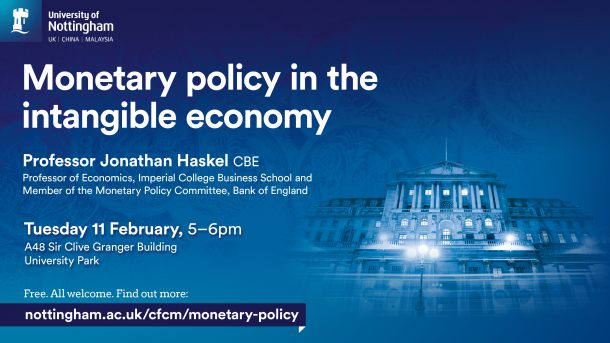

Monetary policy in the intangible economy

Early in the twenty-first century, for the first time, the major developed economies began to invest more in intangible assets, like design, branding, R&D, or software, than in tangible assets, like machinery, buildings, and computers.

But those assets are much harder to borrow against. And firms using them can scale up production much more readily. So how does the intangible economy change monetary policy?

This speech, which should be accessible to non-economists, sets out some first thoughts on the effect of intangibles on long-run interest rates and the short-run monetary transmission mechanism.

Please note: the date has changed from that previously advertised (10 February).

Tags: economy, Monetary economics, monetary policy

Leave a Reply

Upcoming Events